President Mahama has officially abolished E-Levy, Betting Tax, Emission Tax and others

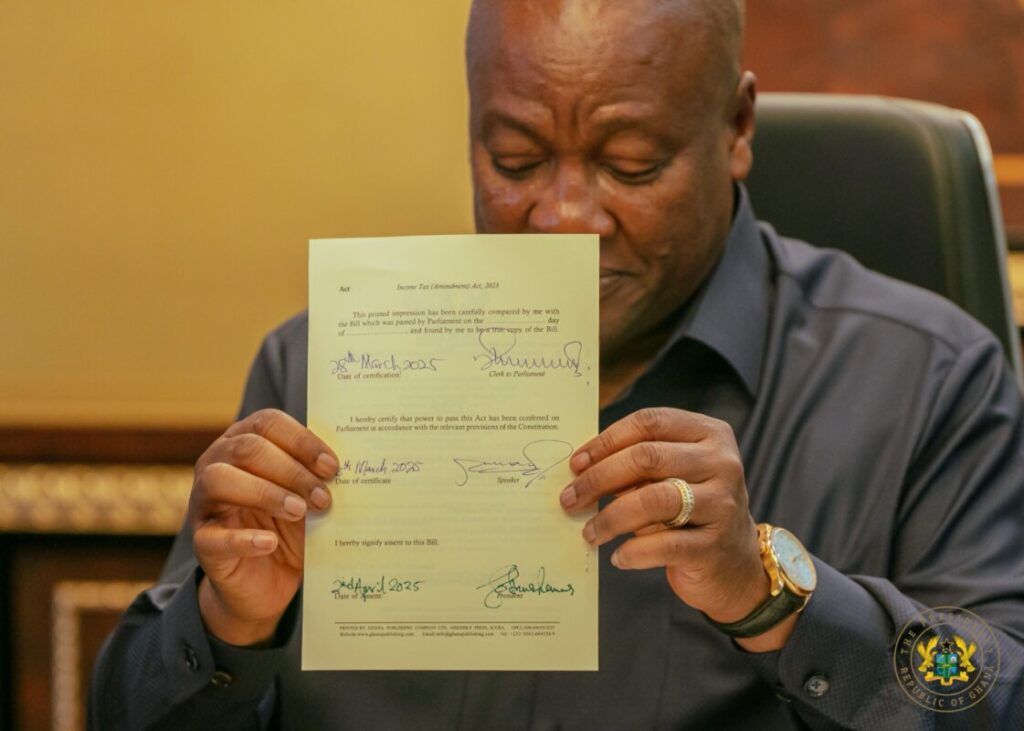

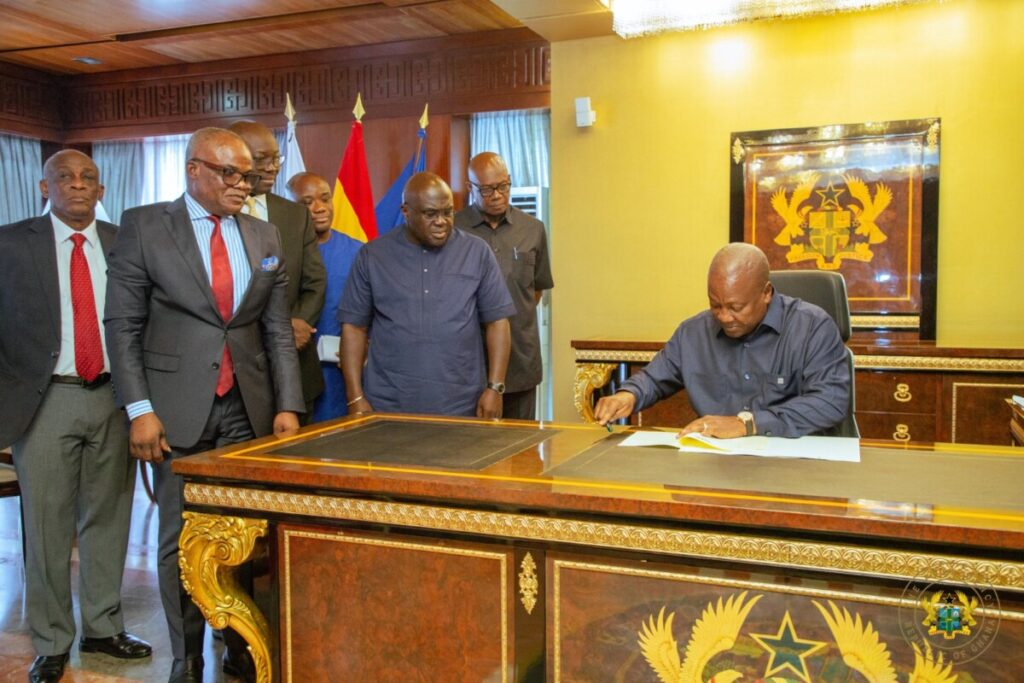

A number of policies aimed at eliminating different taxes, including the Electronic Transfer Levy (E-Levy), Betting Tax, and Emissions Tax, have been signed into law by President John Dramani Mahama.

This action is in line with the National Democratic Congress’s (NDC) commitment to lowering the financial burden on Ghanaians.

Finance Minister Dr. Cassiel Ato Forson laid eight bills before Parliament on March 13, 2025, with the objective of repealing and amending a succession of taxes and levies. The proposals consisted of the Earmarked Funds Capping and Realignment (Amendment) Bill, 2025, Electronic Transfer Levy (Repeal) Bill, 2025, Emissions Levy (Repeal) Bill, 2025, and the Income Tax (Amendment) Bill, 2025.

A 1% tax was imposed on all digital transactions, including online purchases and mobile money, when the E-Levy was first proposed in 2022. As a result of the apparent impact on discretionary expenditure, there had been strong opposition to its introduction. The Betting Tax had also been criticized by gaming stakeholders for imposing a 10% tax on gross gambling winnings of gambling businesses.

Former flagbearer of the National Democratic Congress (NDC), John Dramani Mahama, pledged to eliminate these levies in his first 120 days of government if he prevails before the 2024 general elections.

His government has delivered that campaign vow through the recent passage of the reworked tax measures.

GRTCC suspends planned ‘August 8’ 20% public transport fare increase

GRTCC suspends planned ‘August 8’ 20% public transport fare increase  State funeral for helicopter crash victims set for August 15 at Black Star Square

State funeral for helicopter crash victims set for August 15 at Black Star Square  Black Queens rank 67th in FIFA ranking despite WAFCON performance

Black Queens rank 67th in FIFA ranking despite WAFCON performance